Exempt goods and goods taxable at 5 are defined by the HS tariff code. Class of person eg.

The following person are exempted from Sales Tax.

. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia. Exported manufactured goods will be excluded from the sales tax act. Importer may be exempted from payment of Sales Tax under Item 39 Schedule A of the Exemption Order upon re-importation of the pallets.

Such exemption is granted in the Sales Tax Exemption from Licensing Order 1972. The abovementioned Exemption Order refers to the Sales Tax Persons Exempted from Payment of Tax Order 2018. The SST exemption is for all passenger vehicles including MPVs and SUVs but does not include trucks that are considered commercial vehicles.

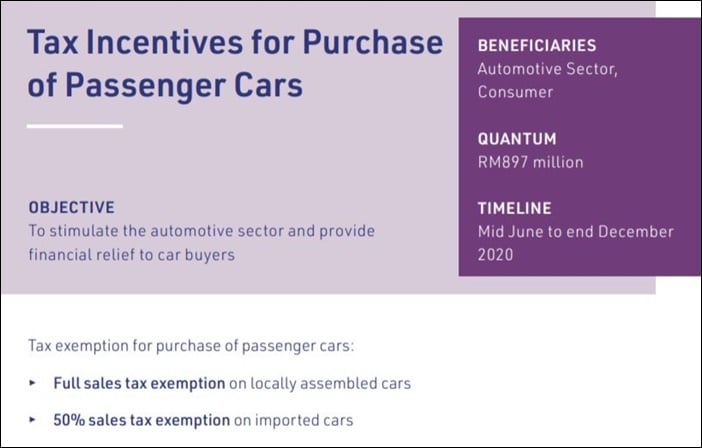

To maintain and increase the demand and sales momentum of passenger vehicles affected by COVID-19 the government introduced a full sales tax exemption on locally-assembled passenger vehicles including MPVs and SUVs and a 50 per cent sales tax exemption on imported passenger vehicles CBU from June 15 2020 to June 30 2022. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. From 1 April 2022 Malaysias public health measures were eased and our borders are now open for business.

As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent. Download form and document related to RMCD. The governments decision to allow buyers to continue enjoying the sales tax exemption as long as they book their vehicles by June 30 is a relief for both the automotive industry and consumers said Perusahaan Otomobil Kedua Sdn Bhd PeroduaPerodua president and chief executive officer Datuk Zainal Abidin Ahmad said local.

The Ministry of Finance on 20 June 2022 issued a media release regarding the sales tax exemption available with regard to the purchase of passenger cars. Application for Import Duty Exemption on Raw Materials Component. So far a total of 868422 units of vehicles have been sold and the people have benefited from the sales tax exemption amounting to RM47 billion.

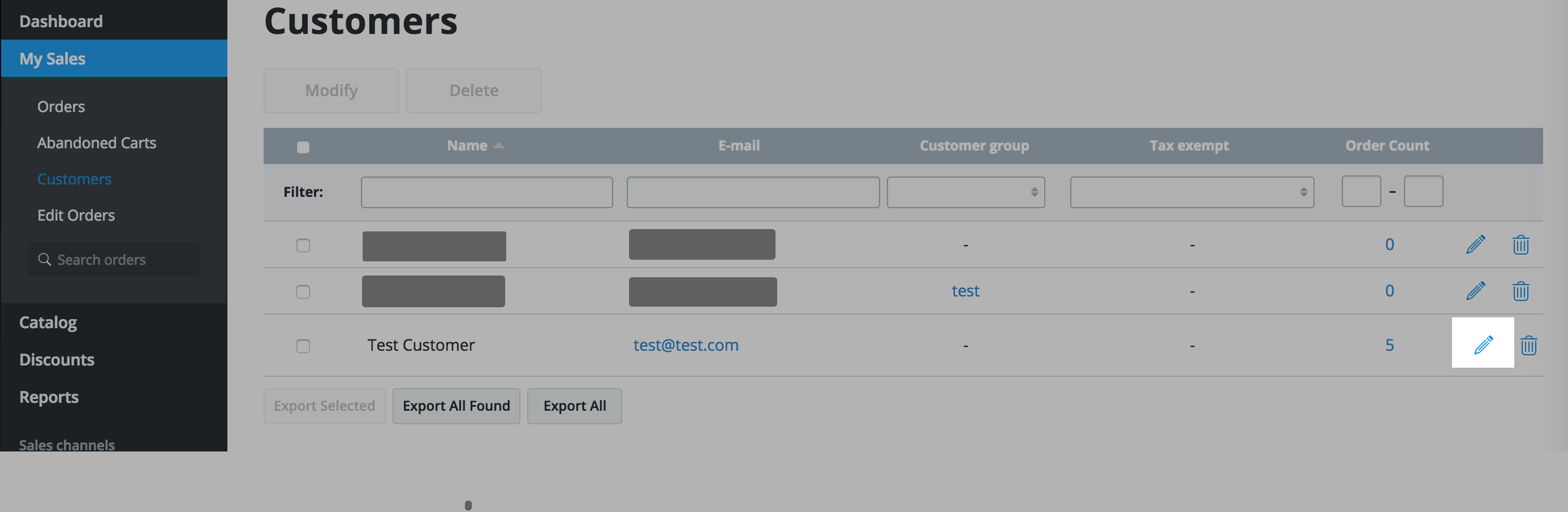

Ruler of States Federal of State Government Department Local Authority Inland Clearance Depot Duty Free Shop. In the past month the industry has been hopeful that the government will again extend the exemption till the end of 2022. Exemption from payment of sales tax Minister may exempt any person from payment of sales tax charged and levied on any taxable goods manufactured or imported Subject to conditions Approval on individual basis Exemption by Sales Tax Persons Exempted From Sale Tax Order 2018 Specific person or to class or category of person.

The Government may extend the sales tax exemption for new vehicles to aid recovery for the automobile industry which has been facing many challenges during the lockdown says Dr. Sales tax exemption expansion. GETTING READY FOR SALES TAX EXEMPTION APPLICATION.

Download the respective format. Proton Instagram pic June 20 2022 KUALA LUMPUR The deadline for the sales tax exemption for the purchase of passenger vehicles remains on June 30 2022 Finance Minister Tengku Datuk Seri. Best viewed in Google.

Exemption on sales tax for cars extended to June 30 2022. The vehicle sales tax exemption will end on June 30 as planned says Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz. Any registered manufacturer to importpurchase raw materials components and packaging materials excluding petroleum exempted from the payment of sales tax formerly CJ5.

The Sales Tax Persons Exempted from Payment of Tax Amendment No2 Order 2020 was published in the official gazette on 5 October 2020 and is effective 6 October 2020. Sales tax exemption on purchase of passenger cars ends 30 June 2022. This SST exemption is part of the Malaysian governments Penjana program to stimulate the local economy.

Manufacturer of specific non taxable goods exemption of tax on the acquisition of raw materials components packaging to be used. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. Effective from 1 September 2018 Sales Tax Act 2018 and the Service Tax Act 2018 together with its respective subsidiary legislations are introduced to replace the Goods and Service GST Act 2014.

According to the release the sales tax exemptionan exemption that began 15 June 2022 for 100 of the purchase. Item 1 Schedule C. 100 for CKD locally assembled cars.

Note that this is the first Policy issued by RMCD on Sales Tax matters. The Schedule A of the Sales Tax Exemption from Licensing Order 1972 stipulates that manufacturers with an annual sales turnover of taxable goods not exceeding RM100000 are exempted from the requirement of applying for a sales tax licence. Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the Sales Tax which are meant for export and also on control items under the Ration Control Act 1961 which is bound under the.

Malaysia Sales Service Tax SST. The sales tax SST Exemption would cover. Car buyers will be able to enjoy an exemption on sales tax for a while longer as the government extends the.

Under the Sales Tax Act 2018 sales tax is charged and levied on imported and. Application for Import Duty andor Sales Tax Exemption on Machinery Equipment. To date a total of 868422 units of vehicles have been sold during the period of sales tax exemption and the government has sacrificed RM47 billion of taxes according to the Finance Ministry.

The sales tax rate is at 510 or on a specific rate or exempt. The sales tax exemptionreduction is applicable from 15-June to 31-December 2020. However buyers who booked their vehicles during the tax.

KUALA LUMPUR June 21.

Sales Tax Exemption Honda Malaysia S Revised Price List Autobuzz My

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Charitable Institution Can T Be Denied Income Tax Exemption For Collecting Service Charges From Its Donors To Defray Administrative Cost Delhi Hc A2z Taxcorp Llp

Sales Tax Exemption Bmw And Mini Malaysia New Prices Autobuzz My

Goods And Person Exempted From Sales Tax Sst Malaysia

Sst Exemption Extended Yet Again Till 31st December 2021 Automacha

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Simbolo De Libra Como Economizar Dinheiro Graficos Financeiros

What Are The Sst Exempt Ckd Cars You Can Buy In Malaysia In 2021 Wapcar

2021 Isuzu D Max Gets New 1 9l 4x2 At Plus Variant In Malaysia From Rm100 999 Rear Wheel Drive Only Paulta Isuzu D Max Rear Wheel Drive Commercial Vehicle

Handling Tax Exempt Customers In Ecwid Ecwid Help Center

Sales Tax Exemptions 50 For Cbu And 100 For Ckd Vehicles Autobuzz My

Bir Rmc No 124 S 2020 Tax Exemption Of Cooperatives

Sales Tax Exemption Volvo Revised Price List Announced Up To Rm23k Less Autobuzz My